rhode island income tax withholding

The income tax wage table has been updated. Please use Microsoft Edge browser to get the best results when downloading a form.

State W 4 Form Detailed Withholding Forms By State Chart

No action on the part of the employee or the personnel office is necessary.

. Rhode Island Division of Taxation. Ad Download or Email RI RI W-4 More Fillable Forms Register and Subscribe Now. Withholding Tax Forms RI Division of Taxation Withholding Tax Forms All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format To have forms mailed to you please call 4015748970 Withholding tax forms now contain a 1D barcode.

Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax. A resident is defined as anyone who is domiciled in the state or who spends. UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be calculated and withheld.

Human Resources - 330 Whitmore Building - 181 Presidents Drive - Amherst MA 01003 - Contact - Site Map. If your state tax witholdings are greater then the amount of income tax you owe the state of Rhode Island you will receive an income tax refund check from the government to make up the difference. The income tax wage table has changed.

Form Ri W3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller. Your payment schedule ultimately will depend on the average amount you hold from employee wages over time. What you need to know.

Laws 44-30 Contact Us. Additionally employers in other states may wish to withhold Rhode Island personal income tax from wages of their Rhode Island employees as a convenience to those employees. Rhode island income tax withholding Sunday May 8 2022 Edit.

The more you withhold the more frequently youll need to make withholding tax payments. Rhode Island regulatory law provides that a Rhode Island employer must withhold Rhode Island income tax from the wages of an employee if. A person is domiciled outside Rhode Island but is living in a home maintained by him in Rhode Island for more than 183 days of the tax year and therefore is considered a resident for the personal income tax purposes of this state.

Please refer to the form instructions for your tax returns to determine how to make a payment by check. The income tax withholding for the State of Rhode Island includes the following changes. Some employers will be required to file and pay RI withholding tax by electronic means.

No action on the part of the employee or the personnel office is necessary. Subscribe for tax news. To receive free tax news updates send an e-mail with SUBSCRIBE in subject line.

WEEKLY - If the employer withholds 600 or more for a calendar month. One Capitol Hill Providence RI 02908. Up to 25 cash back In Rhode Island there are five possible payment schedules for withholding taxes.

Permit to make sales at retail. Residents and nonresidents including resident and nonresident estates and trusts are required to pay estimated taxes for each taxable year if the estimated tax can reasonably be expected to be 250 or more in excess of. Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax.

REPORTING RHODE ISLAND TAX WITHHELD. The income tax is progressive tax with rates ranging from 375 up to 599. Employers must report and remit to the Division of Taxation the Rhode Island income taxes they have withheld on the following basis.

The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. The Rhode Island tax liability before any withholding or credits is 800 and his tax liability to State X before. The annualized wage threshold where the annual exemption amount is eliminated has increased from 227050 to 231500.

Paper forms make use of scanlines to aid in processing. The Rhode Island withholding law requires employers in the state to withhold Rhode Island income tax from wages of residents for performing services both inside and outside the state and of nonresidents for service performed within the state. Paying Social Security Taxes On Earnings After Full Retirement Age.

If you have any questions or need additional information call 401 574-8829 option 4 or email TaxNonRes713taxrigov. Guide to tax break on pension401kannuity income. The income tax withholding for the State of Rhode Island includes the following changes.

Personal Income Tax - Taxpayer Assistance Email. Along with your Federal return at the same time as your Rhode Island tax return. A the employees wages are subject to Federal income tax withholding and b any part of the wages were for services performed in Rhode Island 280-RICR-20-55-106C1.

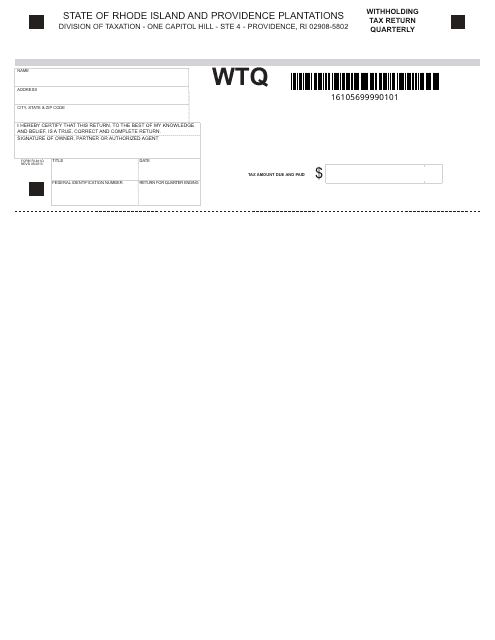

Daily quarter-monthly monthly quarterly and annually. If you do not have a RI location print the form and mail it in with applicable fees Income tax withholding account including withholding for pensions or trusts Rhode Island Unemployment insurance account including Rhode Island temporary disability insurance TDI and Rhode Island job development fund tax Only the registration for the permit. In adv 2021-11 the rhode island division of taxation announced that it has extended through july 17 2021 previously extended through may 18 2021 emergency regulations that temporarily waive the requirement that employers withhold rhode island state income tax from the wages of employees temporarily working within the state solely due to.

The Rhode Island withholding law requires employers in the state to withhold Rhode Island income tax from wages of residents for performing services both inside and outside the state and of nonresidents for service performed within the state. For more information on Nonresident Real Estate Withholding see Withholding Tax on the Sale of Real Property by Nonresidents 280-RICR-20-10-1. Forms Toggle child menu.

An employer may withhold Rhode Island personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding. If the employers average Rhode Island withholding for the previous calendar year is 200 or more per month the employer is required to file and remit the monthly. It should take one to three weeks for your refund check to be processed after your income tax return is recieved.

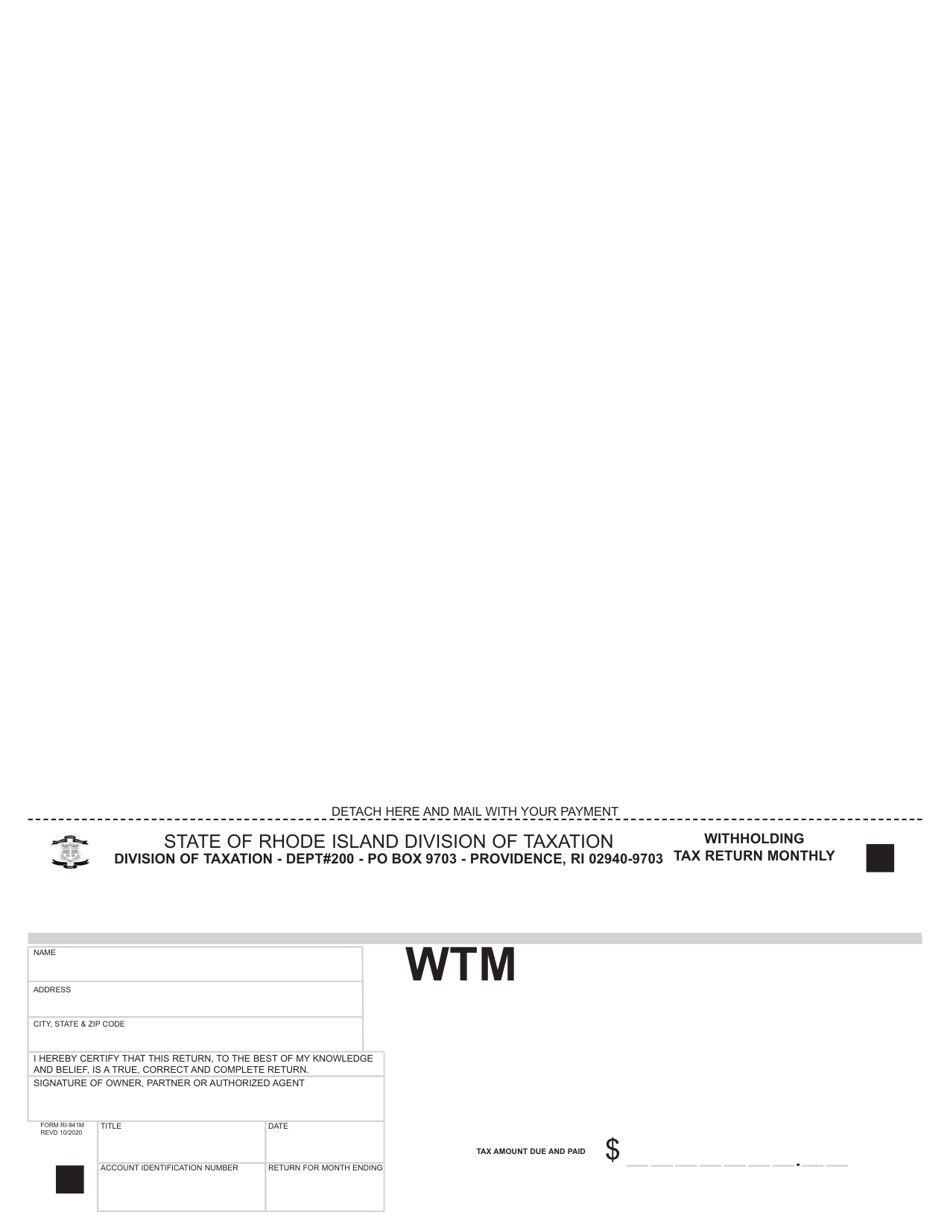

The annualized wage threshold where the annual exemption amount is eliminated has changed from 234750 to 241850. Form RI-941 is to be filed on or before the last day of the following month.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State Income Tax Rates Highest Lowest 2021 Changes

State W 4 Form Detailed Withholding Forms By State Chart

Form Ri 941m Download Fillable Pdf Or Fill Online Withholding Tax Return Rhode Island Templateroller

Cleverus Wins Most Promising Awards At Star Outstanding Business Awards Soba 2019 Business Awards Internet Marketing Strategy Online Marketing

When Are Taxes Due In 2022 Here Are All The Major Deadlines Money

Tax Tips For Agents Part 2 Tax Deductions Top Mortgage Lenders Tax Write Offs

State Of Rhode Island Division Of Taxation Division Rhode Island Government

State Of Rhode Island Division Of Taxation Division Rhode Island Government

Form Wtq Download Fillable Pdf Or Fill Online Withholding Tax Return Quarterly Rhode Island Templateroller

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

Where S My Rhode Island State Tax Refund Taxact Blog

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Income Tax Ri State Tax Calculator Community Tax

What Is Local Income Tax Types States With Local Income Tax More

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov