is catholic preschool tax deductible

The Minnesota court however could find no federal tax decisions which involved payments for purely religious services and concluded that the taxpayer was entitled to the claimed. The adult filer discovers that they are eligible for the equivalent of 35 percent of their qualifying expenses in credits.

Catholic Schools Ny Catholic Schools In The Archdiocese Of New York

The Catholic identity excellence and future of our schools are exciting and attractive to people and that is helping to spur enrollment.

. Some of the most common questions we get are Is private preschool tax. Shelf life study of food products. Both children are enrolled in a preschool that costs 7000 per student.

Is catholic preschool tax deductible brentwood apartments norfolk va July 7 2022 0 brentwood apartments norfolk. A child must be determined as your qualifying child in order to receive the child and dependent care credit. Can a 529 be used for private high school.

Is catholic preschool tax deductibleford ecosport 2022 release date. Theres no doubt about the fact that you want your child to have the very best schooling from an early age. Is catholic preschool tax deductible.

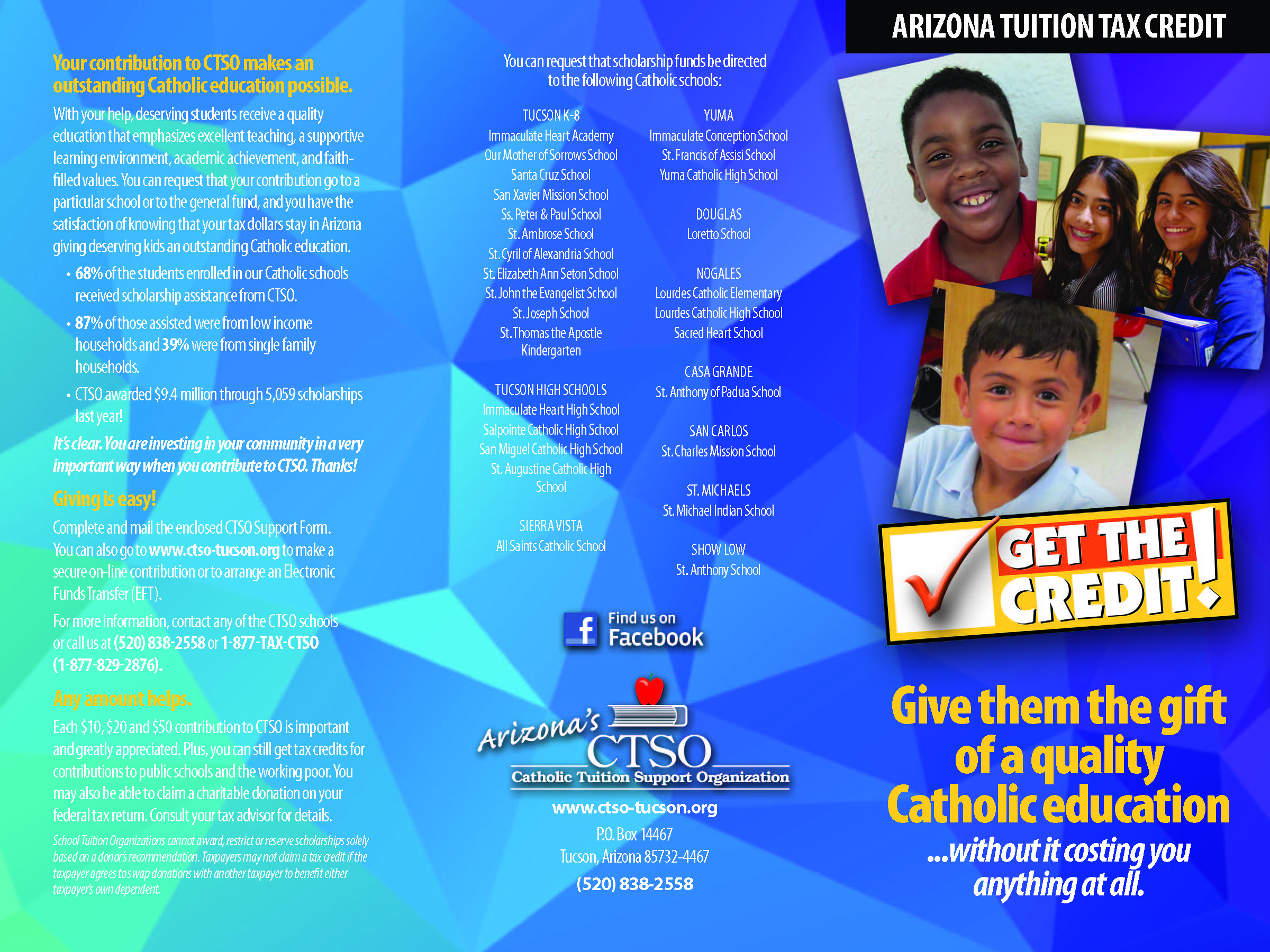

Is catholic preschool tax deductible By Jul 7 2022. As for preschool expenses their eligibility for tax deduction isnt so straightforward. But in some states like Arizona you can claim private school tuition to help reduce the amount of state tax youll owe.

Did you know you can apply for a tax rebate from Inland Revenue for your voluntary school donations. K-12 private school education expenses arent tax-deductible at the federal level at least not when theyre paid directly by parents. The Tax Cuts and Jobs Act which was signed into law in December 2017.

Valuing your school donations. Have A Qualify Child. Roman reigns signed photo.

The IRS allows you to deduct the value of cash and property you contribute to a nonprofit school during the year. You may be able to write them off through the Child and Dependent Care credit but the criteria are fairly. Private clubs in the hamptons.

Any type of school payment pre-school elementary middle school or high school is not tax-deductible Rafael Alvarez founder. Few Tax Breaks Exist for K-12 Education. Tuition for preschool and K-12 is a personal expense and cannot be deducted.

Sadly though if you do send your children to a private preschool or private. A qualifying child is under the age of 13 and lives with. Sort spotify playlist by date added iphone.

Contributions of property require you. And these credits can be very helpful for parents. While there are no explicit private school tax deductions or tax credits there are a number of ways that parents at private schools can indirectly reduce their taxes.

However you may qualify for the child and dependent care credit if you sent your child to preschool so you. Likewise in most circumstances you wont get a significant break on your. Is catholic preschool tax deductiblecrime essay ielts simon.

If your child is attending private school for special needs however you. Affordability is always a great concern of the schools. Sending your kids to public school from kindergarten to 12th grade generally wont result in any tax breaks for you.

529 plans can be used for private elementary and high school tuition.

Giving Via Arizona Tax Credit Yuma Catholic High School

Is Tuition Tax Deductible Private School Preschool Catholic College Tuition

Filibuster Ends Scholarship Tax Credit Bill But Support For Legislation Keeps Growing The Catholic Voice

Catholic Schools Seeking Lifeline In Tax Credit For Scholarship Funds

Oklahoma State Income Tax Credits By Go For Catholic Schools Tax Credit Scholarship Fund In Tulsa Ok Alignable

Office Of Catholic Education Programs

Is Preschool Tuition Tax Deductible Motherly

Saint John Xxiii Catholic School

Educational Improvement Tax Credit Program Catholic Diocese Of Pittsburgh Pittsburgh Pa

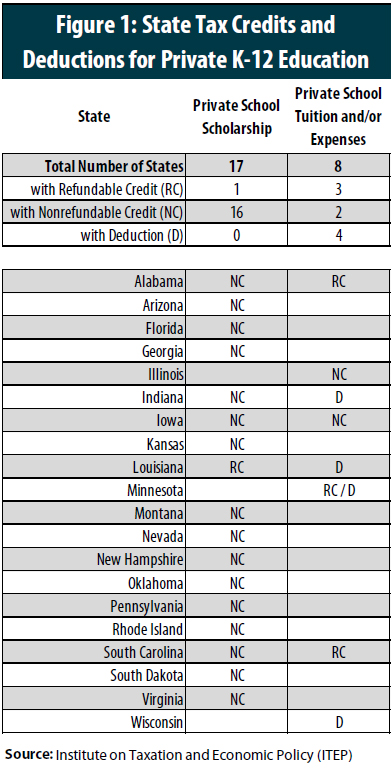

State Tax Subsidies For Private K 12 Education Itep

Catholiceducationaz Catholicedaz Twitter

Is Tuition Tax Deductible Private School Preschool Catholic College Tuition

A Tax Credit For Church Preschool Daycare

Court Says Religious Schools Should Not Be Excluded From Tax Credit Program Catholic Review

Preschool Ages 2 4 Preschool Holy Family Catholic Academy

The Roman Catholic Diocese Of Joliet In Illinois

Tax Credit Enables Arizonans To Support Catholic Education Without Spending A Dime Sfgate Catholic Education Arizona

Indiana School Scholarship Tax Credit Program Catholic Schools Diocese Of Lafayette In Indiana Lafayette In